Buy vs lease luxury car presents a dilemma that many affluent individuals face when considering their next vehicle. The decision hinges on several factors, including financial implications, personal preferences, and lifestyle needs. Understanding the nuances between buying and leasing can significantly impact your driving experience and your wallet.

As we delve into the basics of buying versus leasing luxury cars, we’ll explore the financial considerations, long-term commitments, maintenance responsibilities, and how each option affects your lifestyle and status. This comprehensive analysis will help you navigate the luxury car market with confidence.

Understanding the Basics of Buying and Leasing Luxury Cars: Buy Vs Lease Luxury Car

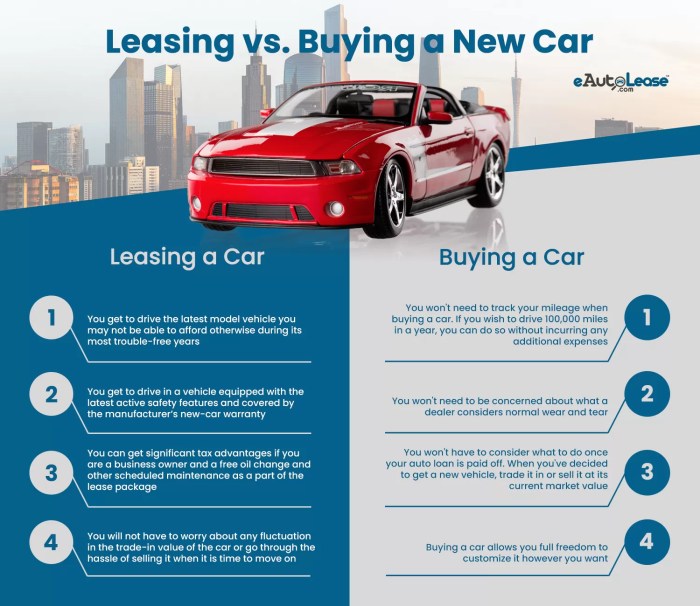

When it comes to acquiring a luxury vehicle, potential buyers often grapple with the decision of whether to buy or lease. Each option offers distinct advantages and challenges, making it crucial to understand both processes and their financial implications. Buying typically involves owning the vehicle outright, while leasing provides the flexibility of temporary use without the long-term commitment of ownership.

Buying a luxury car means paying the full purchase price, either upfront or through financing. This option ultimately leads to ownership, allowing the buyer to keep the vehicle for as long as desired. In contrast, leasing a luxury vehicle involves paying for its depreciation during the lease term, usually spanning 2 to 4 years. At the end of the lease, the car is returned to the dealership. Understanding these foundational differences is essential for making an informed decision.

Financial Considerations

The financial implications of buying versus leasing luxury cars are significant and warrant careful consideration.

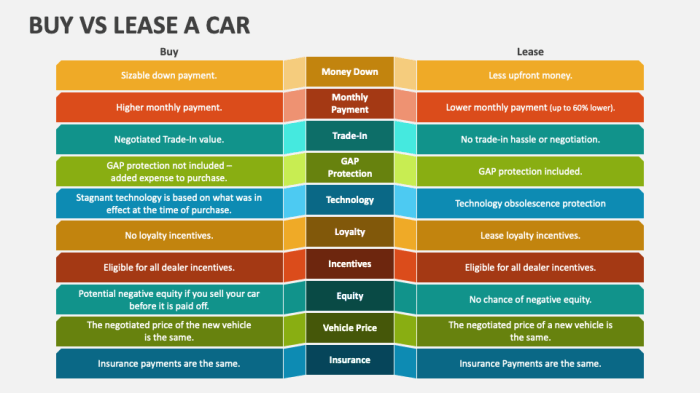

- Initial Costs: Buying a luxury car generally requires a larger upfront payment, which can include a down payment and applicable taxes. Leasing typically involves lower initial costs, often limited to the first month’s payment and a security deposit.

- Monthly Payments: Lease payments are typically lower than loan payments for buying, making leasing an appealing option for those who want to drive a luxury car without incurring high monthly costs.

- Total Cost of Ownership: Over time, buying a car can lead to greater value as the owner retains the vehicle. Leasing, while offering lower monthly payments, does not build equity and may result in higher long-term costs if leases are continuously renewed.

- Tax Implications: The tax treatment for leasing can differ from buying. In many cases, lease payments may be tax-deductible for business use while sales tax is usually paid outright when purchasing a vehicle.

Long-term Commitment vs. Short-term Flexibility

The decision to buy or lease a luxury car often hinges on the buyer’s lifestyle and preferences regarding commitment and flexibility.

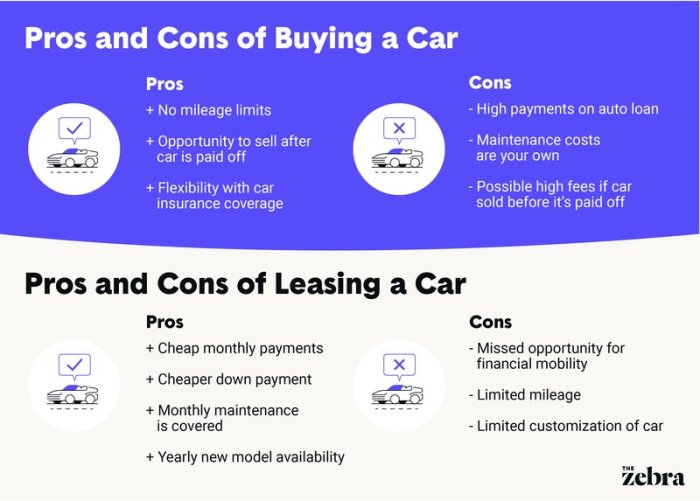

Buying a luxury vehicle represents a long-term commitment, as it requires ownership for several years, which can be advantageous for those who want to drive the same car for an extended period without facing mileage restrictions. This option fits the needs of individuals who prefer stability and intend to keep the vehicle in good condition for resale later.

Leasing, on the other hand, provides short-term flexibility. Many professionals appreciate the ability to drive a new luxury car every few years without the hassle of selling an older model. Leasing is ideal for individuals whose needs may change frequently, allowing them to adjust their vehicle choice based on changing personal or professional situations.

Maintenance and Warranty Coverage

Ownership versus leasing also impacts maintenance responsibilities and warranty considerations.

When buying a luxury car, owners are responsible for all maintenance and repair costs once the manufacturer’s warranty expires. This can become expensive, especially for high-end brands known for costly parts and services. Conversely, leased vehicles are often covered under warranty for the duration of the lease, minimizing maintenance costs for lessees.

Luxury brands often provide comprehensive warranties that cover major components, making leasing an attractive option for those seeking peace of mind regarding maintenance expenses. Lessees can enjoy the experience of driving a new vehicle without worrying about unexpected repair bills that may arise from owning an older car.

Vehicle Depreciation and Resale Value, Buy vs lease luxury car

Understanding how depreciation affects luxury cars is crucial for making an informed choice between buying and leasing.

Luxury cars typically experience significant depreciation within the first few years, impacting their resale value. When buying, this depreciation can lead to financial loss if the vehicle is sold at a lower price than the original purchase cost. Conversely, leasing alleviates concerns about depreciation since the lessee returns the vehicle at the end of the lease term, effectively sidestepping the costs associated with resale.

Leased vehicles also have a predetermined residual value, which influences lease payments. Cars with higher residual values generally result in lower lease payments, making brands like Lexus and Porsche popular choices due to their strong resale values, while others may depreciate more rapidly.

Insurance and Additional Costs

Insurance considerations differ when buying versus leasing a luxury car.

Leased vehicles often require more comprehensive insurance coverage, as lenders want to protect their investment. Owners of bought luxury cars might opt for less coverage once the vehicle is fully paid off.

Additional costs, such as registration fees, taxes, and possible lease-end charges for excess wear and mileage, should also be factored into the overall financial comparison.

| Cost Type | Leased Vehicles | Owned Vehicles |

|---|---|---|

| Insurance Requirements | Higher coverage required | Lower coverage options available |

| Initial Costs | Lower upfront payment | Higher upfront costs |

| Monthly Payments | Generally lower | Higher due to financing |

Lifestyle and Usage Considerations

Lifestyle choices significantly influence the decision to buy or lease a luxury vehicle.

For individuals who frequently travel for work or have a dynamic lifestyle, leasing can provide the flexibility to choose a different car that better suits their current needs. Conversely, those with stable job situations and a preference for long-term ownership may find buying a luxury car more beneficial.

Driving habits also play a role; those who drive extensively may incur additional mileage fees when leasing, making buying a more suitable option for high-mileage users.

Personal Preferences and Psychological Factors

The emotional aspects tied to owning versus leasing a luxury car can greatly influence purchasing decisions.

Owning a luxury vehicle is often associated with status and personal identity, leading buyers to derive satisfaction from the pride of ownership. In contrast, lessees may enjoy the novelty of driving a new car every few years, which can also enhance their social standing.

Satisfaction levels can vary significantly between buyers and lessees. Research indicates that while buyers often report feeling a deeper emotional connection to their vehicles, lessees appreciate the freedom and flexibility their arrangement provides. These psychological factors are essential to consider when deciding between buying and leasing a luxury car.

Closing Summary

In summary, whether you choose to buy or lease a luxury car ultimately depends on your financial situation, driving habits, and personal preferences. Both options come with distinct advantages and drawbacks, making it essential to weigh them carefully against your lifestyle needs. By considering all the factors discussed, you’ll be better equipped to make a decision that brings you satisfaction and joy on the road.